Summary - OTP Group’s first nine months 2025 results

published atNovember 7, 2025Tags:results

Summary - OTP Group’s first nine months 2025 results

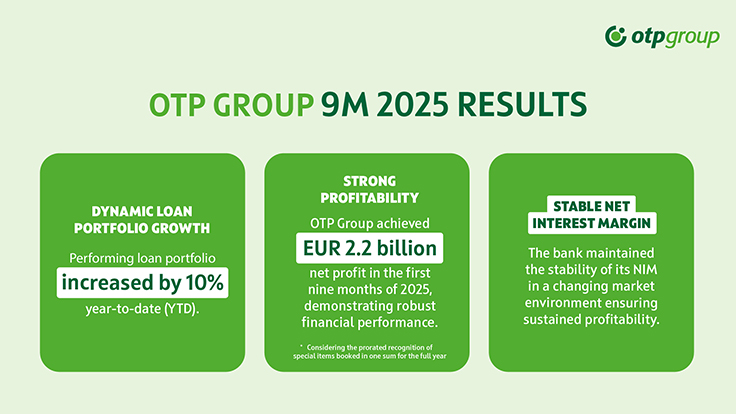

In the first nine months of 2025 OTP Group achieved outstanding results with cumulated profit after tax amounting to HUF 886 billion/EUR 2.2 billion and ROE reaching 22.7% with the even recognition of special expenditure items (special banking taxes in Hungary, supervisory charges in Bulgaria, Hungary and Slovenia) booked at the beginning of the year in lump-sum for the whole year.

The

reported cumulated profit after tax, so unfiltered of the distorting effect of

these above-mentioned special items, reached HUF 849 billion/EUR 2.1 billion,

up by 3% y-o-y, resulting in an ROE of 21.8%. Had these special items

recognized in one sum for the whole year been booked evenly within the year,

the nine months profit after tax would have been higher by HUF 36.7 billion/EUR

91 million.

In the first nine months profit before tax improved by 8% y-o-y, fuelled by the 16% increase in operating profit. Within that, total income grew by 13% y-o-y in HUF terms, and by 14% FX-adjusted and organically, so without the effect of the sale of the Romanian operation. Within core banking revenues, the cumulated net interest income advanced by 9% y-o-y, matching the FX-adjusted and organic increase. The key driver behind this was the expansion of business volumes, whereas the net interest margin improved by 2 bps, to 4.30%.

Cumulated operating expenses grew by 11% y-o-y organically and FX-adjusted, driven mainly by the double-digit increase in both personnel expenses and depreciation. Personnel expenses growth was induced primarily by wage inflation which typically surpassed inflation, while the increasing depreciation was to a great extent influenced by IT CAPEX. The cumulated cost to income ratio stood at 39.3% assuming the even recognition of the already mentioned special items, the full annual amount of which were accounted at the beginning of the year in one sum. This marks an improvement compared to the full-year 2024 indicator of 41.3%.

Credit quality remained stable, and the main credit quality indicators continued to show favourable trends. Consolidated performing (Stage 1+2) loans expanded by 3% q-o-q, bringing the cumulated year-to-date growth rate to 10%. Consolidated deposits expanded by 4% q-o-q and 9% ytd on an FX-adjusted basis. The Group’s net loan to deposit ratio hit 74% at the end of September 2025.

At the end of September 2025, the consolidated Common Equity Tier 1 (CET1) ratio according to IFRS under the prudential scope of consolidation reached 18.4%, marking 0.5 pp decrease against the end of 2024, but improved by 0.4 pp q-o-q. The consolidated capital adequacy ratio (CAR) stood at 20.1% at the end of September, underpinning a year-to-date decrease of 0.2 pp.

OTP Group’s management reaffirmed its earlier guidance for the Group’s 2025 performance as they are not expecting a meaningful change in the operating environment, with geopolitical uncertainties persisting.