OTP Group: summary of the first quarter of 2025

published atMay 13, 2025Tags:results

OTP Group: summary of the first quarter of 2025

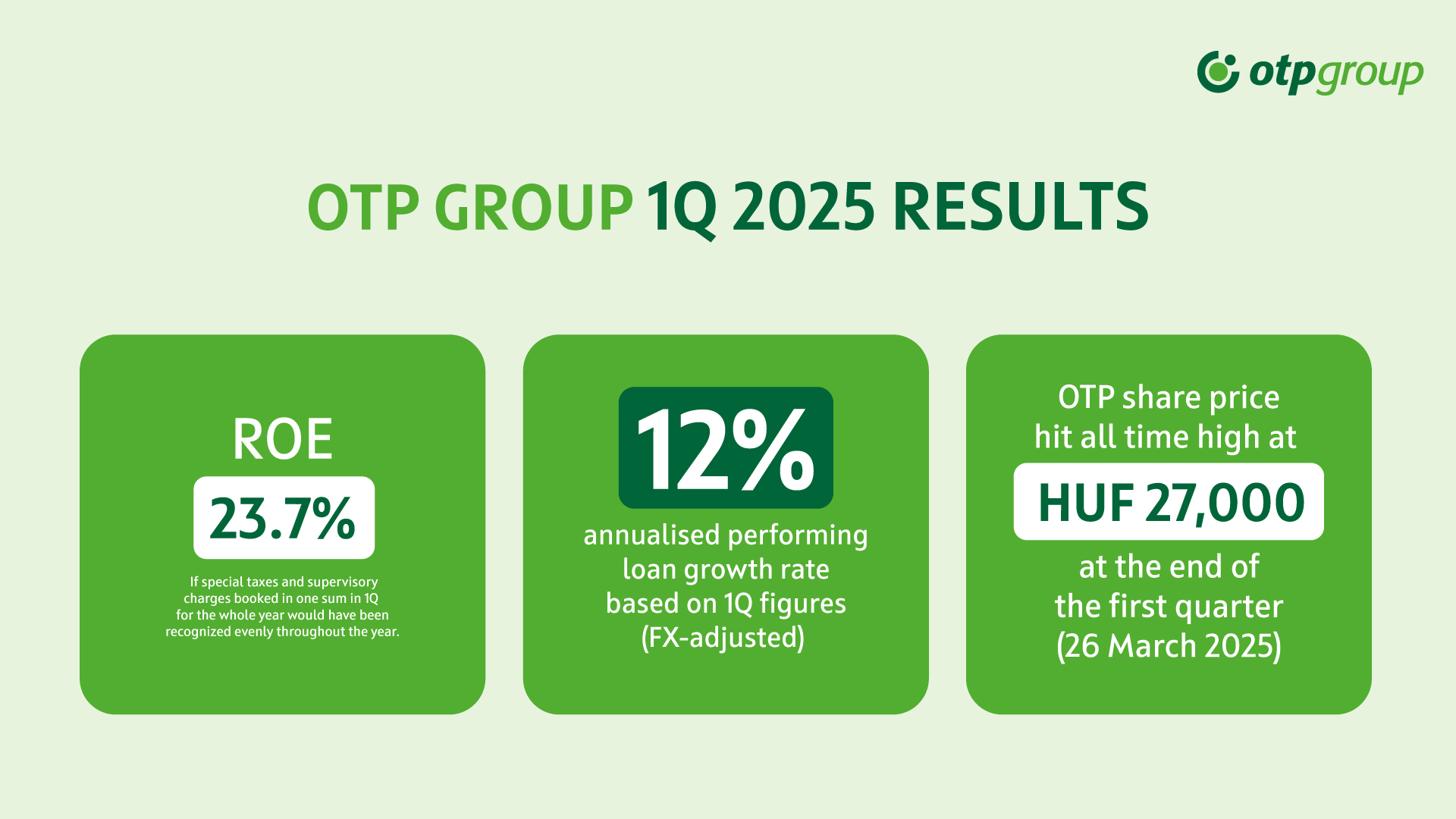

In the first quarter of 2025 OTP Group’s profit after tax amounted to HUF 189 billion/EUR 466 million, which is consistent with 14.9% Return on Equity.

Several

special negative items weighed on the 1Q profitability, as their full annual

amount was recognized in one sum in the first quarter. These items (special banking

taxes in Hungary, supervisory charges in Bulgaria, Hungary and Slovenia) reduced

the 1Q profit after tax by altogether HUF 135 billion/EUR 333 million. Had

these items been booked evenly throughout the year, the 1Q profit after tax

would have reached HUF 299 billion/EUR 737 million, implying an ROE of 23.7%.

Profit before tax improved by 19% q-o-q and 10% y-o-y. The y-o-y growth was fuelled by the 22% increase in operating profit, while the q-o-q growth reflected positive P&L effects of the declining total risk costs from the high 4Q base, amid q-o-q stable operating profit. Total income grew by 15% y-o-y in HUF terms, and by 16% organically and FX-adjusted, while net fees and commissions expanded by 14% y-o-y.

Operating expenses went up by 10% y-o-y organically and on an FX-adjusted basis, driven mainly by the 15% increase in both personnel expenses related primarily to wage inflation and depreciation influenced by IT CAPEX. Operating costs decreased by 6% q-o-q on an FX-adjusted basis, partly due to the seasonally higher 4Q base. The cost to income ratio moderated by 3.2 pps y-o-y, to 40.8%.

Consolidated credit quality remained stable, main credit quality indicators continued to develop favourably. While the ratio of Stage 3 loans under IFRS 9 declined by 0.1 pp q-o-q and 0.7 pp y-o-y to 3.5%.

Consolidated performing (Stage 1+2) loans expanded by 3% q-o-q, which led the annual growth accelerating to 11% without the effect of the deconsolidation of Romania and FX-adjusted. Consolidated deposits expanded by 3% q-o-q on an FX-adjusted basis, culminating in 9% y-o-y growth organically, so without the effect of the divestment of Romania. The Group’s net loan to deposit ratio hit 73% at the end of 1Q 2025, thus remained unchanged q-o-q.

At

the end of 1Q 2025, the consolidated Common Equity Tier 1 (CET1) ratio

according to IFRS and under the prudential scope of consolidation reached

18.0%, marking 0.9 pp decrease against the end of 2024. The consolidated

capital adequacy ratio (CAR) stood at 20.0% at the end of March, underpinning a

q-o-q decrease of 0.4 pp.

OTP Group’s management reaffirmed its earlier guidance for the Group’s 2025 performance as they are expecting marginal improvement in the operating environment. The FX-adjusted organic performing loan volume growth may be above 9% reported in 2024 while the net interest margin may be similar to the 4.28% achieved last year. Similar to this, CIR may be somewhat higher, and ROE may be lower than in 2024 (41.3% and 23.5% respectively), due to the expected decrease in leverage. Portfolio risk profile may be similar to 2024.

For more information please click here.