Dept capital market funding

OTP Bank Nyrt. €7,000,000,000 Euro Medium Term Note Programme 2025

(documents are available only in English)

- Base Prospectus

- Base Prospectus First Supplement

- Summary of the first quarter 2025 results

- Consolidated IFRS Financial Statements 2024

- Consolidated IFRS Financial Statements 2024 – Independent Auditor’s report

- Consolidated IFRS Financial Statements 2023

- Consolidated IFRS Financial Statements 2023 – Independent Auditor’s report

- Agency Agreement

- Deed of Covenant

- Articles of Association

Last update: 20/06/2025

OTP Bank Nyrt. Domestic Bond Issuing Programme 2025-2026

(documents are available only in Hungarian)

- Base Prospectus

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

Last update: 17/11/2025

Summary of international debt securites issued by OTP Bank

| Type of Instrument | ISIN | Outstanding Notional (million) | Issued | Matures | Actual coupon | |

|---|---|---|---|---|---|---|

| Tier 2 Notes issue of OTP Bank | Tier 2 | XS2586007036 | USD 650 | 15/02/2023 | 15/05/2033, callable by the Issuer between 15/02/2028 and 15 /05/2028 | From 15/02/2023 to 15/05/2028: 8.75% p.a. |

| Tier 2 Notes issue of OTP Bank | Tier 2 | XS2988670878 | USD 750 | 30/01/2025 | 30/07/2035, callable by the Issuer between 30/01/2030 and 30/07/2030 | From 30/01/2025 to 30/07/2030: 7.30% p.a. |

| Senior Preferred issue of OTP Bank | Senior Preferred | XS2626773381 | USD 500 | 25/05/2023 | 25/05/2027, callable by the Issuer on 25/05/2026 | From 25/05/2023 to 25/05/2026: 7.5% p.a. |

| Senior Preferred issue of OTP Bank | Senior Preferred | XS2698603326 | EUR 650 | 05/10/2023 | 05/10/2027, callable by the Issuer on 05/10/2026 | From 05/10/2023 to 04/10/2026: 6.125% p.a. |

| Senior Preferred issue of OTP Bank | Senior Preferred | XS2754491640 | EUR 600 | 31/01/2024 | 31/01/2029, callable by the Issuer on 31/01/2028 | From 31/01/2024 to 30/01/2028: 5% p.a. |

| Green Senior Preferred issue of OTP Bank | Senior Preferred | XS2838495542 | EUR 700 | 12/06/2024 | 12/06/2028, callable by the Issuer on 12/06/2027 | From 12/06/2024 to 11/06/2027: 4.75% p.a. |

| Senior Preferred issue of OTP Bank | Senior Preferred | XS2871018136 | CNY 300 | 31/07/2024 | 31/07/2027, callable by the Issuer on 31/07/2026 | From 31/07/2024 to 31/07/2027: 4.1% p.a. |

| Senior Preferred issue of OTP Bank | Senior Preferred | XS2917468618 | EUR 500 | 16/10/2024 | 16/10/2030, callable by the Issuer on 16/10/2029 | From 16/10/2024 to 15/10/2029: 4.25% p.a. |

| Green Senior Preferred issue of OTP Bank | Senior Preferred | XS3102027383 | CNY 900 | 30/06/2025 | 30/06/2028, callable by the Issuer on 30/06/2027 | From 30/06/2025 to 30/06/2027: 3.5% p.a. |

Type of Instrument

ISIN

Outstanding Notional (million)

Issued

Matures

Actual coupon

- Tier 2 Notes issue of OTP BankTier 2

- Tier 2 Notes issue of OTP BankTier 2

- Senior Preferred issue of OTP BankSenior Preferred

- Senior Preferred issue of OTP BankSenior Preferred

- Senior Preferred issue of OTP BankSenior Preferred

- Green Senior Preferred issue of OTP BankSenior Preferred

- Senior Preferred issue of OTP BankSenior Preferred

- Senior Preferred issue of OTP BankSenior Preferred

- Green Senior Preferred issue of OTP BankSenior Preferred

- Tier 2 Notes issue of OTP BankXS2586007036

- Tier 2 Notes issue of OTP BankXS2988670878

- Senior Preferred issue of OTP BankXS2626773381

- Senior Preferred issue of OTP BankXS2698603326

- Senior Preferred issue of OTP BankXS2754491640

- Green Senior Preferred issue of OTP BankXS2838495542

- Senior Preferred issue of OTP BankXS2871018136

- Senior Preferred issue of OTP BankXS2917468618

- Green Senior Preferred issue of OTP BankXS3102027383

- Tier 2 Notes issue of OTP BankUSD 650

- Tier 2 Notes issue of OTP BankUSD 750

- Senior Preferred issue of OTP BankUSD 500

- Senior Preferred issue of OTP BankEUR 650

- Senior Preferred issue of OTP BankEUR 600

- Green Senior Preferred issue of OTP BankEUR 700

- Senior Preferred issue of OTP BankCNY 300

- Senior Preferred issue of OTP BankEUR 500

- Green Senior Preferred issue of OTP BankCNY 900

- Tier 2 Notes issue of OTP Bank15/02/2023

- Tier 2 Notes issue of OTP Bank30/01/2025

- Senior Preferred issue of OTP Bank25/05/2023

- Senior Preferred issue of OTP Bank05/10/2023

- Senior Preferred issue of OTP Bank31/01/2024

- Green Senior Preferred issue of OTP Bank12/06/2024

- Senior Preferred issue of OTP Bank31/07/2024

- Senior Preferred issue of OTP Bank16/10/2024

- Green Senior Preferred issue of OTP Bank30/06/2025

- Tier 2 Notes issue of OTP Bank15/05/2033, callable by the Issuer between 15/02/2028 and 15 /05/2028

- Tier 2 Notes issue of OTP Bank30/07/2035, callable by the Issuer between 30/01/2030 and 30/07/2030

- Senior Preferred issue of OTP Bank25/05/2027, callable by the Issuer on 25/05/2026

- Senior Preferred issue of OTP Bank05/10/2027, callable by the Issuer on 05/10/2026

- Senior Preferred issue of OTP Bank31/01/2029, callable by the Issuer on 31/01/2028

- Green Senior Preferred issue of OTP Bank12/06/2028, callable by the Issuer on 12/06/2027

- Senior Preferred issue of OTP Bank31/07/2027, callable by the Issuer on 31/07/2026

- Senior Preferred issue of OTP Bank16/10/2030, callable by the Issuer on 16/10/2029

- Green Senior Preferred issue of OTP Bank30/06/2028, callable by the Issuer on 30/06/2027

- Tier 2 Notes issue of OTP BankFrom 15/02/2023 to 15/05/2028: 8.75% p.a.

- Tier 2 Notes issue of OTP BankFrom 30/01/2025 to 30/07/2030: 7.30% p.a.

- Senior Preferred issue of OTP BankFrom 25/05/2023 to 25/05/2026: 7.5% p.a.

- Senior Preferred issue of OTP BankFrom 05/10/2023 to 04/10/2026: 6.125% p.a.

- Senior Preferred issue of OTP BankFrom 31/01/2024 to 30/01/2028: 5% p.a.

- Green Senior Preferred issue of OTP BankFrom 12/06/2024 to 11/06/2027: 4.75% p.a.

- Senior Preferred issue of OTP BankFrom 31/07/2024 to 31/07/2027: 4.1% p.a.

- Senior Preferred issue of OTP BankFrom 16/10/2024 to 15/10/2029: 4.25% p.a.

- Green Senior Preferred issue of OTP BankFrom 30/06/2025 to 30/06/2027: 3.5% p.a.

Last update: 13/10/2025

You can download the above table in excel format here.

Summary of domestic debt securites of OTP Group offered for subscription

| Type of Instrument | ISIN | Subscription period | Date of Issuance | Maturity | Actual coupon | |

|---|---|---|---|---|---|---|

| OTP_HUF_2027/1 | Fixed Rate Bond | HU0000366075 | 15/12/2025 - 16/01/2026 | 16/01/2026 | 16/01/2027 | 6.00% p.a. |

Type of Instrument

ISIN

Subscription period

Date of Issuance

Maturity

Actual coupon

- OTP_HUF_2027/1Fixed Rate Bond

- OTP_HUF_2027/1HU0000366075

- OTP_HUF_2027/115/12/2025 -

16/01/2026

- OTP_HUF_2027/116/01/2026

- OTP_HUF_2027/116/01/2027

- OTP_HUF_2027/16.00% p.a.

Last update: 15/12/2025

Summary of the main terms and conditions of outstanding bond issues of

OTP Bank together with the Final Terms in pdf format can be reached here.

(documents are available only in Hungarian)

Last update: 15/12/2025

Read more about outstanding issues

- Announcement of the redemption of RON 170 million Senior Preferred Notes (13/10/2025)

- Announcement of the redemption of USD 60 million Green Senior Preferred Notes (29/09/2025)

- Announcement of the issue of CNY 900 million Green Senior Preferred Notes (30/06/2025)

- Announcement of the redemption of EUR 110 million Senior Non-Preferred Notes (27/06/2025)

- Announcement of the redemption of EUR 75 million Senior Non-Preferred Notes (23/06/2025)

- Announcement of the redemption of EUR 650 million Senior Preferred Notes (04/03/2025)

- Announcement of the redemption of EUR 500 million Tier 2 Notes (07/02/2025)

- Announcement of the issue of USD 750 million Tier2 Notes (30/01/2025)

- Announcement of the issue of EUR 500 million Senior Preferred Notes (16/10/2024)

- Announcement of the issue of CNY 300 million Senior Preferred Notes (01/08/2024)

- Announcement of the redemption of EUR 400 million Green Senior Preferred Notes (15/07/2024)

- Announcement of the redemption of EUR 500 million Tier 2 Notes (15/07/2024)

- Announcement of the issue of EUR 700 million Green Senior Preferred Notes (12/06/2024)

- Announcement of the issue of EUR 600 million Senior Preferred Notes (31/01/2024)

- Announcement of the issue of EUR 650 million Senior Preferred Notes (05/10/2023)

- Announcement of the issue of USD 500 million Senior Preferred Notes (25/05/2023)

- Announcement of the issue of USD 650 million Tier2 Notes (15/02/2023)

Matured Euro Medium Term Note Programmes

(documents are available only in English)

OTP Bank Nyrt. €7,000,000,000 Euro Medium Term Note Programme 2024

- Base Prospectus

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Summary of the first nine months 2024 results

- Consolidated, condensed IFRS Financial Statements 1H 2024 (condensed)

- Half-year Financial Report - First half 2024 results

- Summary of the first quarter 2024 results

- Consolidated IFRS Financial Statements 2023

- Consolidated IFRS Financial Statements 2023 – Independent Auditor’s report

- Consolidated IFRS Financial Statements 2022

- Consolidated IFRS Financial Statements 2022 – Independent Auditor’s report

- Agency Agreement

- Deed of Covenant

- Articles of Association

OTP Bank Nyrt. €5,000,000,000 Euro Medium Term Note Programme 2023

- Base Prospectus

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

- Base Prospectus Fifth Supplement

- Summary of the first nine months 2023 results

- Consolidated IFRS Financial Statements 1H 2023

- Half-year Financial Report First half 2023 result

- Summary of the first quarter 2023 results

- Consolidated IFRS Financial Statements 2022

- Consolidated IFRS Financial Statements 2022 – Independent Auditor’s report

- Consolidated IFRS Financial Statements 2021

- Consolidated IFRS Financial Statements 2021 – Independent Auditor’s report

- Agency Agreement

- Deed of Covenant

- Articles of Association

OTP Bank Nyrt. €5,000,000,000 Euro Medium Term Note Programme 2022

- Base Prospectus

- Consolidated IFRS Financial Statements 2020

- Consolidated IFRS Financial Statements 2021

- Consolidated IFRS Financial Statements 2021 – Independent Auditor’s report

- Summary of the first quarter 2022 results

- Consolidated IFRS Financial Statements 1H 2022

- Summary of the first nine months 2022 results

- Agency Agreement

- Deed of Covenant

- Articles of Association

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

Last update: 06/02/2023

OTP Bank Nyrt. €5,000,000,000 Euro Medium Term Note Programme 2021

- Base Prospectus

- Consolidated IFRS Financial Statements 2020

- Consolidated IFRS Financial Statements 2019

- Summary of the first quarter 2021 results

- Agency Agreement

- Deed of Covenant

- Articles of Association

- Base Prospectus First Supplement

- Consolidated Financial Statements 1H 2021

- Summary of the first nine months 2021 results

Last update: 14/01/2022

OTP Bank Nyrt. €5,000,000,000 Euro Medium Term Note Programme 2020

- Base Prospectus

- Consolidated IFRS Financial Statements 2019

- Consolidated IFRS Financial Statements 2018

- Agency Agreement

- Deed of Covenant

- Articles of Association

Last update: 06/05/2020

Matured Domestic Bond Issuing Programmes

(documents are available only in Hungarian)

OTP Bank Nyrt. HUF 800,000,000 Domestic Bond Issuing Programme 2024-2025

- Base Prospectus

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

- Base Prospectus Fifth Supplement

- Base Prospectus Sixth Supplement

Last update: 21/07/2025

OTP Bank Nyrt. HUF 800,000,000 Domestic Bond Issuing Programme 2023-2024

- Base Prospectus

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

- Base Prospectus Fifth Supplement

- Base Prospectus Sixth Supplement

- Base Prospectus Seventh Supplement

- Base Prospectus Eighth Supplement

- Base Prospectus Ninth Supplement

- Base Prospectus Tenth Supplement

Last update: 19/06/2024

OTP Bank Nyrt. HUF 200,000,000 Domestic Bond Issuing Programme 2022-2023

- Base Prospectus

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Consolidated IFRS Financial Statements 1H 2022

- Summary of the first nine months 2022 results

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

- Base Prospectus Fifth Supplement

- Base Prospectus Sixth Supplement

- Base Prospectus Seventh Supplement

- Base Prospectus Eighth Supplement

- Base Prospectus Ninth Supplement

- Base Prospectus Tenth Supplement

- Base Prospectus Eleventh Supplement

- Base Prospectus Twelfth Supplement

- Base Prospectus Thirteenth Supplement

- Base Prospectus Fourteenth Supplement

- Base Prospectus Fifteenth Supplement

- Base Prospectus Sixteenth Supplement

- Base Prospectus Seventeenth Supplement

Last update: 03/08/2023

OTP Bank Nyrt. HUF 200,000,000 Domestic Bond Issuing Programme 2021-2022

- Base Prospectus

- Consolidated IFRS Financial Statements 2021

- Consolidated IFRS Financial Statements 2021 – Independent Auditor’s report

- Consolidated IFRS Financial Statements 2020

- Summary of the first quarter 2022 results

- Base Prospectus First Supplement

- Base Prospectus Second Supplement

- Base Prospectus Third Supplement

- Base Prospectus Fourth Supplement

- Base Prospectus Fifth Supplement

- Base Prospectus Sixth Supplement

- Base Prospectus Seventh Supplement

Last update: 20/06/2022

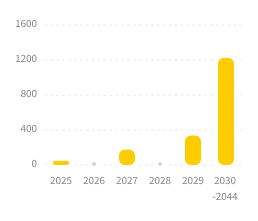

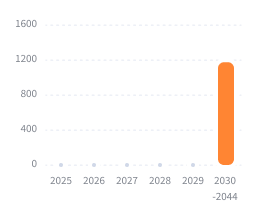

Maturity profile of OTP Group’s securities and loans

Maturity profile of OTP Group’s securities and loans as of 30 september 2025 (in EUR million)

Last update: 07/11/2025